Microsoft Dynamics 365

Dynamics 365 is an end-to-end business management system in the cloud and represents a major opportunity for Dynamics Partners. Dynamics 365 is meant to increase Microsoft’s share of their customer’s strategic technology and increasing Microsoft share of the greater cloud market. It gives partner an opportunity to create apps or country specific localizations which will be integrated to Dynamic 365.

UAE VAT Localizations

As a part of the localized requirements for the United Arab Emirates (UAE), the VAT localizations is an extension developed to incorporate the VAT specific requirements in the UAE. In this whitepaper we will examine how UAE VAT localization can be seamlessly implemented on Dynamics 365. This document will provide details about setups, configuration and reporting requirements related to UAE VAT as per the guidelines provided by UAE Federal Tax Authority.

Value Added Tax (VAT)

Value Added Tax or VAT is a tax on the consumption or use of goods and services levied at each point of sale. VAT is a form of indirect tax and is used in more than 180 countries around the world. The VAT to be collected or paid is decided based on the type of goods being transacted and the category of the customer being transacted with. There generally are multiple combination of product and customer/ vendor groups created and a VAT % is defined for a given combination. Businesses are supposed to collect and account for the tax on behalf of the government and hence VAT becomes a part of all the sales and purchase transactions in the system. At the end of a VAT cycle any business is expected to calculate a VAT claim or submission which is a net of the VAT paid and collected by the business.

Value Added Tax (VAT) in UAE

VAT was introduced in the UAE on 1 January 2018. The rate of VAT currently is 5 per cent for the applicable categories while there are some categories that are completely exempted from VAT. VAT will provide the UAE with a new source of income which will be continued to be utilized to provide high-quality public services. It is expected that the VAT would be further fine-tuned to encourage or discourage certain goods and services by controlling the VAT %age levied upon them. Implementations of VAT makes it mandatory for the ERP to be UAE VAT compliant. Dynamics 365 comes in a localized flavor for UAE which is FTA (Federal Tax Authority) VAT compliant.

VAT Setups

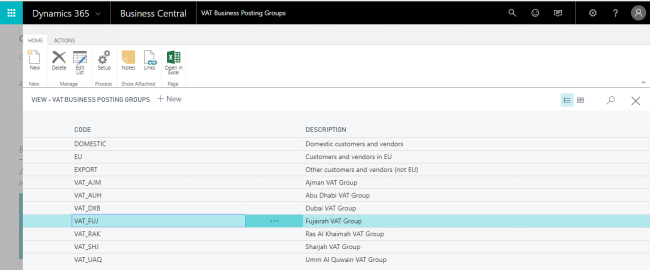

VAT Business Posting Group: -

As per the FTA guidelines, VAT business posting groups should represent the markets in which the business is being performed. As business is done with customers and vendors this results in a list of VAT Business Posting Groups, and defines how to calculate and post VAT in each market.

Examples of VAT business posting groups are:

- VAT_DXB

- VAT_SJH

- VAT_FUJ

- VAT_AUH

- VAT_RAK

- VAT_AJM

- VAT_KSA

- VAT_UAQ

- VAT_GCC

- VAT_OTHERS

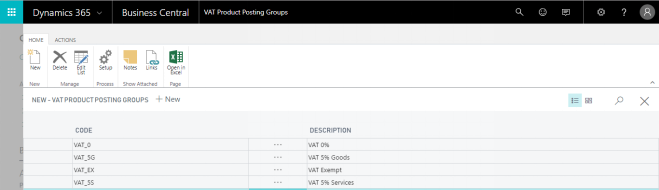

VAT Product Posting Group:-

VAT product posting groups represent the items and services that a business deals with. Based on the category that a good or service belongs to the FTA classifies them as one the following:

- EX – Exempted

- ZR – Zero rated

- SR- Standard rated (5%)

The above information is used to define the different VAT product posting groups to be configured for UAE as:

- VAT_0%

- VAT_EX

- VAT_5G

- VAT_5S

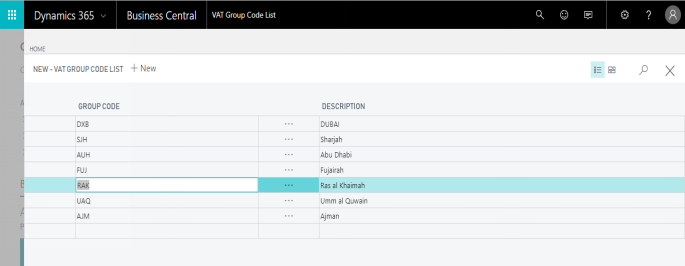

VAT Group Code (UAE - Emirates):-

UAE VAT return report requires that the VAT output is classified by each emirates. To cater for the requirement a new grouping has been added to the system this is called the VAT Group Code.

Data in VAT group code should correspond to each emirate and in the current configuration should have the following values:

- DXB – Dubai

- AUD- Abu Dhabi

- SHJ- Sharjah

- AJM – Ajman

- UAQ – Umm Al Qwain

- RAK – Ras Al Khaimah

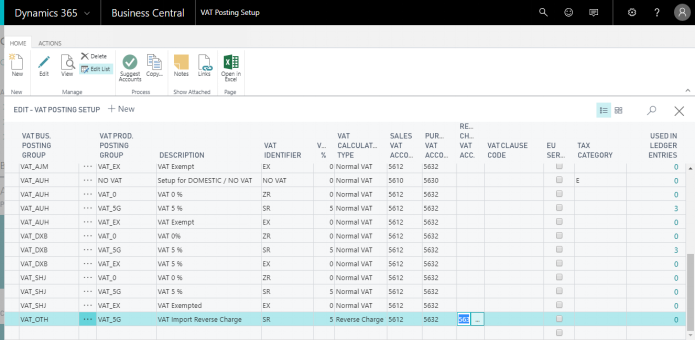

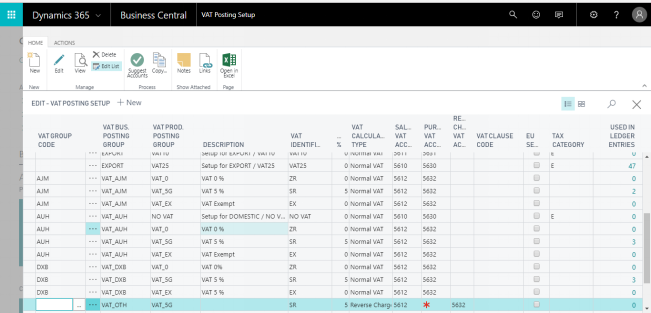

VAT Posting Setup:-

Dynamics 365 calculates VAT amounts on sales and purchases transactions, based on VAT posting setups. A VAT Posting Setup is a combinations of VAT business and product posting group.

A VAT Posting setup allows for the following:

- VAT percent

- VAT calculation type, and

- • General ledger accounts for posting VAT for sales, purchases, and reverse charges.

Import Reverse Charge:-

Reverse Charge by definition is the amount of VAT that one would have paid on an imported item, if one had bought it in the UAE. This mechanism exempts an overseas seller to register for and collect VAT for the government, instead the buyer is held responsible to pay the VAT on behalf of the seller.

Reverse charge is applicable in the UAE while importing goods or services from outside the GCC countries. To enable Reverse charge on transactions, under VAT posting setups the VAT calculation type is defined as “Reverse Charge” for combination of VAT_OTH, VAT_GCC.